Recent demonetisation of ₹500 and ₹1000 banknotes was a step taken by the Government of India on 8 November 2016, ceasing the usage of all ₹500 and ₹1000 banknotes of the Mahatma Gandhi Series as a form of legal tender in India from 9 November 2016.[1]

The announcement was made by the Prime Minister of India Narendra Modi in an unscheduled live televised address to the nation at 20:15 IST the same day.[2][3] In the announcement, Modi declared circulation of all ₹500 and ₹1000 banknotes of the Mahatma Gandhi Series as invalid and announced the issuance of new ₹500 and ₹2000 banknotes of the Mahatma Gandhi New Series in exchange for the old banknotes.

The banknote denominations of ₹100, ₹50, ₹20, ₹10, ₹5, ₹2, and ₹1 of the Mahatma Gandhi Series continued to remain as legal tender and were unaffected by the policy. The demonetization was done in an effort to stop the counterfeiting of the current banknotes alleged to be used for funding terrorism and for cracking down on black money in the country.[4][5] The move is also aimed at reducing corruption, drug menace and smuggling.

The Governor of the Reserve Bank of India, Urjit Patel also informed that the decision had been made about six months ago, and the printing of new currency notes of denomination ₹500 and ₹2000 had already started. However, only the top members of the government, security agencies and the central bank were aware of the move. But media had reported in October 2016 about introduction of ₹2000 denomination well before the official announcement by RBI.

Now History and background

- The sudden move to demonetize Rs 500 and Rs 1,000 currency notes is not new. Rs 1,000 and higher denomination notes were first demonetized in January 1946 and again in 1978.

- The highest denomination note ever printed by the Reserve Bank of India was the Rs 10,000 note in 1938 and again in 1954. But these notes were demonetized in January 1946 and again in January 1978, according to RBI data.

- Rs 1,000 and Rs 10,000 bank notes were in circulation prior to January 1946. Higher denomination banknotes of Rs 1,000, Rs 5,000 and Rs 10,000 were reintroduced in 1954 and all of them were demonetized in January 1978.

- The Rs 1,000 note made a comeback in November 2000. Rs 500 note came into circulation in October 1987. The move was then justified as attempt to contain the volume of banknotes in circulation due to inflation.

- However, this is the first time that Rs 2,000 currency note is being introduced.

- While announcing currently circulated Rs 500 and Rs 1,000 notes as invalid from midnight 8 Nov, Prime Minister Narendra Modi said new Rs 500 note and a Rs. 2,000 denomination banknote will be introduced from November 10.

- Bank notes in Ashoka Pillar watermark series in Rs 10 denomination were issued between 1967 and 1992, Rs 20 in 1972 and 1975, Rs 50 in 1975 and 1981 and Rs 100 between 1967-1979.

- The banknotes issued during this period contained the symbols representing science and technology, progress and orientation to Indian art forms.

- In the year 1980, the legend Satyameva Jayate — ‘truth alone shall prevail’ — was incorporated under the national emblem for the first time.

- In October 1987, Rs 500 banknote was introduced with the portrait of Mahatma Gandhi and Ashoka Pillar watermark. Mahatma Gandhi (MG) series banknotes – 1996 were issued in the denominations of Rs 5, (introduced in November 2001), Rs 10 (June 1996), Rs 20 (August 2001), Rs 50 (March 1997), Rs 100 (June 1996), Rs 500 (October 1997) and Rs 1,000 (November 2000).

- The Mahatma Gandhi Series – 2005 bank notes were issued in the denomination of Rs 10, Rs 20, Rs 50, Rs 100, Rs 500 and Rs 1,000 and contained some additional/new security features as compared to the 1996 MG series.

- The Rs 50 and Rs 100 banknotes were issued in August 2005, followed by Rs 500 and Rs 1,000 denominations in October 2005 and Rs 10 and Rs 20 in April 2006 and August 2006, respectively.

Bank transactions

In the first four days after the announcement of the step, about 3,000 billion rupees in the form of old ₹500 and ₹1000 banknotes have been deposited in the banking system and about 500 billion rupees have been dispensed by withdrawals from bank accounts, ATMs as well as exchanges over the bank counters. Within these four days, the banking system has handled about 18 crore transactions.[17] The State Bank of India reported to have received more than ₹30,000 crore in bank deposit in first two days after demonetisation.[60][61][62] A spike in the usage of debit card and credit card post demonetisation was also reported.[63]

Income tax raids and cash seizures

Income Tax departments raided various illegal tax-evasive businesses in Delhi, Mumbai, Chandigarh, Ludhiana and other cities that traded with demonetised currency.[64]

Large sum of cash were seized in different parts of the country.[65][66][67][68]

Effect on illegal activities

The move also reportedly crippled Communist guerrilla groups (Naxalites) financing through money laundering.[69][70] On November 10, the police arrested a petrol pump owner at Ranchi when he reportedly tried to deposit ₹ 25 lakh, belonging to a person affiliated with the banned Communist Party of India (Maoist).[71] According to Chhattisgarh Police demonetisation has affected the Naxalite activities. It is reported that insurgents have stashed more than ₹ 7000 crore in the Bastar region.[70][72][73] Mumbai Police reported a setback to Hawala operations.[74][75] Hawala dealers in Kerala were also affected.[76] The Jammu and Kashmir Police reported the effect of demonetsation on hawala transactions of separatists.[77][78]

Evasion attempts

A bag of burnt notes was found in Uttar Pradesh following demonetisation.[79][80] Old 500 and 1000 rupee notes were also found floating in the Ganga river near Mirzapur.[81] In Chhattisgarh liquid cash worth of ₹44 lakh was seized.[82] In Malda,a district believed to be a transit-point for fake Indian currencies,[83] a large sum of cash deposits in dormant accounts were also reported.Authorities of Sri Jalakanteswarar temple at Vellore discovered cash worth ₹ 44 lakh from the temple hundi.[84]

There have also been reports of people circumventing the restrictions imposed on the exchange transactions by making multiple transactions at different bank branches.[85]

Also reports on misusing Jan-Dhan Accounts by luring account holders, investing in agriculture,Gold, Property and buying Second Hand SUVs even search Google for that matter.

Chaos

The scarcity of cash due to demonetisation led to chaos and long queues at ATMs and banks across India. ATMs were running out of cash after a few hours of being functional, and around half the ATMs in the country were non functional. Sporadic violence was reported in New Delhi, people attacked bank premises, and ration shops were looted in Madhya Pradesh. There have been several deaths of people standing in queues to exchange their old banknotes.There have also been deaths attributed to lack of medical help due to refusal of old banknotes by hospitals. Besides reports of lab ours not accepting payments in other form than cash were received from various parts.

Praise

International Monetary Fund (IMF) issued a statement supporting Modi’s efforts to fight corruption by the demonetization policy.[51]

Chinese state media Global Times praised the move and termed it as “fierce fight against black money and corruption.”[52] Former Prime Minister of Finland and Vice President of European Commission Jyrki Katainen welcomed the demonetisation move stressing that bringing transparency will strengthen Indian economy.[53][54]

Swedish Minister of Enterprise Mikael Damberg supported the move by calling it bold decision

Chief Minister of Bihar Nitish Kumar supported the move.The demonetisation also got support from Chief Minister of Andhra Pradesh Nara Chandrababu Naidu. Former Chief Election Commissioner of India S. Y. Quraishi said demonetisation could lead to long term electoral reforms.[40] Indian social activist Anna Hazare hailed demonetisation as a revolutionary step.[41][42][43] The President of India Pranab Mukherjee welcomed the demonetisation move by calling it bold step.

The decision was both praised and criticised by businessmen, bankers and politicians. Several bankers like Arundhati Bhattacharya (Chairperson of State Bank of India), Chanda Kochhar (MD & CEO of ICICI Bank) and Deepak Parekh (Chairman of HDFC) appreciated the move in the sense that it would help curb black money.[24] Businessmen Anand Mahindra (Mahindra Group), Sajjan Jindal (JSW Group), Kunal Bahl (Snapdeal and FreeCharge) also supported the move adding that it would also accelerate e-commerce.[24] Infosys founder N. R. Narayana Murthy praised the move.

Demonetization along with the upcoming Goods and Services Tax (GST) as “an attempt to change the spending habit and lifestyle.

Source:-

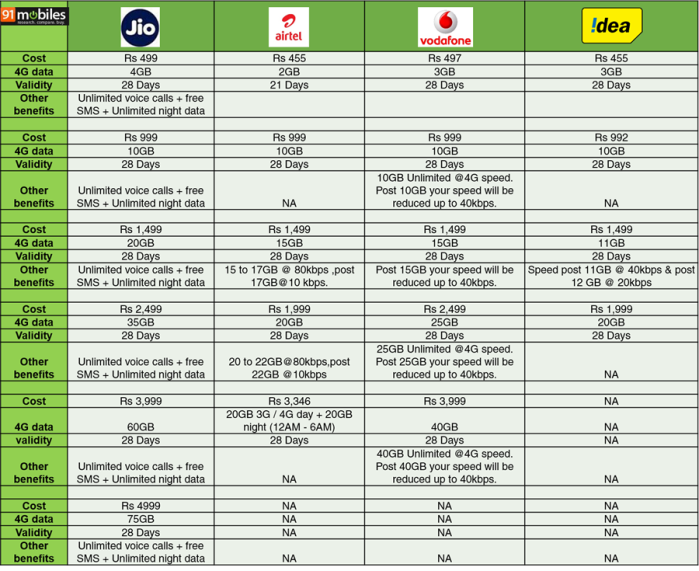

has launched a new 90 day ‘free’ data plan for its prepaid 4G users. The three-month pack is available for Rs 1,495 for existing subscribers and new users can avail it through the first recharge of Rs 1,494. The company says the new pack offers free data for 90 days, but it the fine print reveals otherwise. BUT the pack carries an FUP limit of 30GB for three months from the day of recharge, post which the speed will be reduced to 64Kbps. This is also purely a data plan, so it doesn’t include any talk time or SMS benefits. This plan is currently available in Delhi, and will be launched in other circles in the coming days.

has launched a new 90 day ‘free’ data plan for its prepaid 4G users. The three-month pack is available for Rs 1,495 for existing subscribers and new users can avail it through the first recharge of Rs 1,494. The company says the new pack offers free data for 90 days, but it the fine print reveals otherwise. BUT the pack carries an FUP limit of 30GB for three months from the day of recharge, post which the speed will be reduced to 64Kbps. This is also purely a data plan, so it doesn’t include any talk time or SMS benefits. This plan is currently available in Delhi, and will be launched in other circles in the coming days.

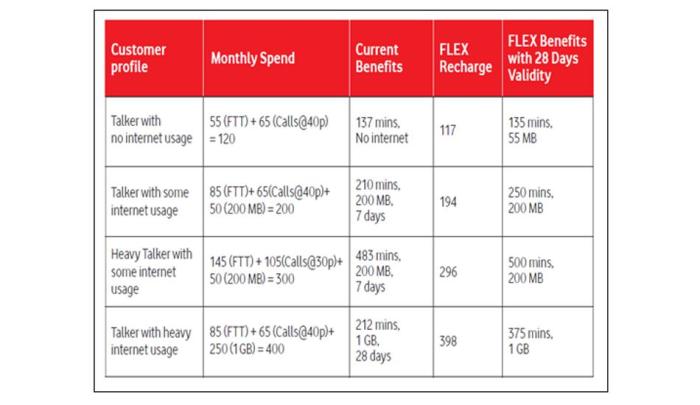

where in there is no pre-fixed quotas for voice, data or SMS. Vodafone FLEX is available in denominations of ranging from Rs 119 (325 Flex), Rs 199 (700 Flex), Rs 299 (1200 Flex) Rs 399 (1750 Flex). Additional packs can also be availed at attractively lower cost. As per Vodafone, Flex customers can carry forward their unsed Flex, keep a tab on their exact usage, and enjoy savings of up to 25%, all this with a single recharge valid for 28 days. With Vodafone Flex, company aims at the pre-paid world by addressing the needs of the customers as 90% of customers prefer to use prepaid and Vodafone FLEX has been specially designed with the singular objective of making the user experience of the hundreds of million prepaid customers simpler, richer and more enjoyable. It gives prepaid customers total control with the flexibility to use their Flex as per their individual choice and usage style – more for voice or more for data – offering greater value for money.”

where in there is no pre-fixed quotas for voice, data or SMS. Vodafone FLEX is available in denominations of ranging from Rs 119 (325 Flex), Rs 199 (700 Flex), Rs 299 (1200 Flex) Rs 399 (1750 Flex). Additional packs can also be availed at attractively lower cost. As per Vodafone, Flex customers can carry forward their unsed Flex, keep a tab on their exact usage, and enjoy savings of up to 25%, all this with a single recharge valid for 28 days. With Vodafone Flex, company aims at the pre-paid world by addressing the needs of the customers as 90% of customers prefer to use prepaid and Vodafone FLEX has been specially designed with the singular objective of making the user experience of the hundreds of million prepaid customers simpler, richer and more enjoyable. It gives prepaid customers total control with the flexibility to use their Flex as per their individual choice and usage style – more for voice or more for data – offering greater value for money.”